The majority trading experts tell you to disregard the fundamentals and concentrate on the technical analysis.

Pretty much every trading publication you select is stuffed with a wide variety of strategies that use technical patterns, indicators or combination of both.

Nearly all retail traders can explain the distinctions between the RSI and Stochastic indicators, but would be baffled by the meaning of PMI reports or the IFO survey.

Fundamentals are hard.

Yes, they are confusing and often times contradictory.

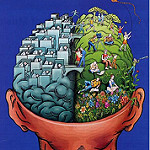

They require understanding of the context; an understanding of what is going on behind the scenes right now, or what might develop in the future based on today’s economic conditions.

It requires you to follow the Micro, as well as the Macro developments of the particular currency, you trade. The Fundamentals analysis certainly appear less objective than a couple of trend lines or Fibonacci ratios on a chart.

I can’t tell you how many times I’ve seen traders get into a trade simply because “…hey man, it looked good on a chart.”

I mean, risk their hard-earned money on a simple Moving Average crossover. And the saddest part of all is, putting on the trade right before the Major news announcement!

You would think, that they’d checked the Calendar for the scheduled news releases, but again “…hey man, who cares? Everything I need to know, is in the charts.”

Photo credit: jamelah via Visual Hunt / CC BY-NC-ND

Be sure to also read:

Are You still Making an Error Trades, even though You have a Trading Plan?

What moves the price?

Only two things, really. Imbalance in Supply/Demand, and the Economic Information; the Macro-picture, and the Micro-releases.

If you believe that your genius new tweak to your ADX settings is the key to your future success, but you have no clue of who Jannet Yellen, or Mario Draghi is, well… I’ve got news for you! You are stepping into the mine field without even knowing it.

Sooner or later, your trading account will suffer a blow from one of their’s “verbal-mines,” as I call them.

In fact, 90% of all retail traders would be much better off if they knew less about technical analysis, but knew more about the weekly scheduled economic events.

Here is some “tough Love” for you my fellow technical analysis junkie:

If you know the difference between the RSI and Stochastic, but can’t tell me who, in Finance world, the above mentioned people are, then you’re a figaro-trader.

If you worship Fibonacci and can defend a thesis on Price Action but have no clue as to what time of the day and what week the Non-Farm payrolls are released, then you’re even a bigger figaro-trader!

Photo credit: jimbo0307 via Visual hunt / CC BY-NC-SA

Photo credit: jimbo0307 via Visual hunt / CC BY-NC-SA

Check-out: If You think, you can beat these guys at their own Game…

Conclusion

If you are just watching the price, and not following the news, you are like a boxer that just stepped into the ring, with one hand, tied behind his back.

Is there any wonder why 90% of retail traders fail to succeed in financial market?

Without any awareness of the Macro-events and the Micro-releases retail traders simply fall prey to more sophisticated and well-informed professional traders.

What Do You Think?

Why 90% of retail traders fail at their craft…

What are the reasons for a failure…

Please leave a comment and let us know.