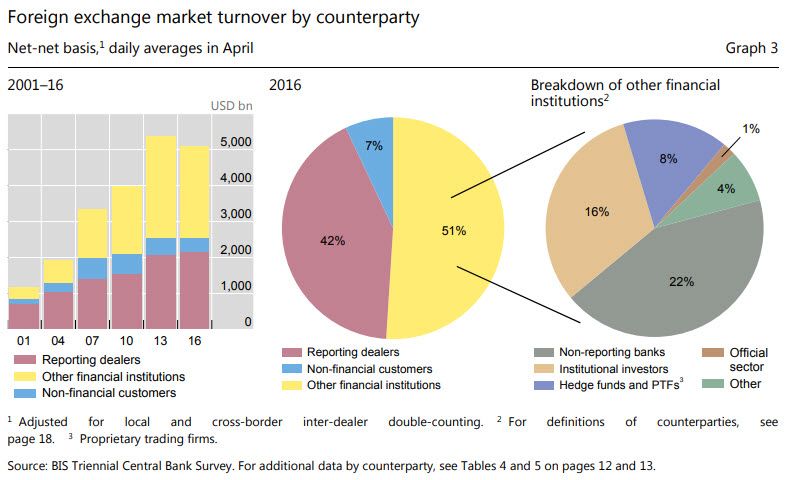

The currency market exchange, or FX – the foreign exchange, is the worldwide financial market for forex currency trading and operates through a floating exchange rate system. It is the largest financial market in the world, with a daily turnover of over 5.1 trillions.

The currency market itself is an auction-based, decentralized International forum. It also is the target of many a would-be home trader’s hopes and dreams of getting rich quick. Before trying to make a run on it, it would be useful to understand more about how the whole currency market exchange actually works.

It exists as a network of independent financial institutions in various locations around the globe acting as trading centers between currency buyers and sellers worldwide. The main function of the currency market exchange is to enable International trade and Investment.

Governments and businesses buying, or selling products and services from a foreign country need to pay for those transactions and convert the profits into their own currency. This accounts for only roughly 7-10% of daily trades. The remaining 90% are for-profit, speculative trades.

Until only recently, individual retail traders were scarce in the forex currency trading.

The Internet trading evolution has brought the FX market within easy reach for the retail investor. This has also brought the forex currency trading, into the mainstream and beyond the realm of the traditional traders such as; large banks and financial institutions, governments, international corporations and hedge fund operators.

An individual’s ability to speculate in the world’s largest and most liquid financial market has brought with it the need for accurate information on how the FX market operates. Many investors are actively seeking the best way to use this intriguing, but often confounding market to diversify their investment portfolios.

For an individual investor, familiar with trading in the regulated Equity markets, the currency market exchange is not akin to anything they’ve encountered before. There is no formal governance of the market, no international oversight, clearing house, or arbitration method for disputes.

The Forex functions successfully as a self-governing market mainly, because member Banks have to keep up a cooperative competition. This works very effectively to regulate and control the market.

The Forex is an Interbank, over-the-counter market with no central, regulated exchange, or trading floor. Transactions and trades take place over the phone, or via the Internet between two parties. Unlike the Equity markets, no effective insider interference is possible for any length of time due to the sheer scope and decentralized nature of the Forex Currency Market.

The currency market exchange is a 24-hour market, operating nearly six days a week because of world time zones. Trading begins each morning in Wellington, and moves around the globe as the business day begins in successive financial centers, first Tokyo, then London, then New York.

This gives retail traders the unprecedented ability to respond to currency fluctuations caused by economic, social, or political events as they occur.

In a Forex transaction, a party purchases an amount of one currency by paying with an amount of a second currency. Transactions, or trades are always made between a pair – two currencies.

While in theory trades could take place between any two world currencies, in actuality, most foreign exchange trading involves the currencies of the most financially powerful countries. Switzerland, while small geographically and not a large political entity, plays a large part in the FX currency markets due to the powerful Swiss banks. Most of the forex currency trading takes place involving the seven major currencies.

International currency pairs: The Majors and The Commodity pairs

The most liquid and the most heavily traded currency pairs are the Majors and their pricing is less volatile than that of smaller foreign currencies.

The Majors that make up about 90% of Forex trades are:

EUR / USD (Euro / US dollar)

USD / JPY (US Dollar / Japanese Yen)

GBP / USD (British Pound / US dollar)

USD / CHF (US Dollar / Swiss Franc)

The Commodity pairs are currencies that are the most commonly traded involving commodities:

AUD / USD (Australian Dollar / US Dollar) associated with gold commodities.

USD / CAD (US Dollar / Canadian Dollar) associated with oil commodities.

NZD / USD (New Zealand Dollar / US Dollar) associated with gold commodities.

Transactions, or trades involving the Majors and the Commodity pairs combined make up about 95% of Forex activity. Of the Majors, the US dollar is the most significant single currency, with involvement in 85% of trades.

The British Pound is next, followed by the Japanese Yen, the European Euro, and the Swiss Franc. The Currency Market Exchange is a much more concentrated place than Equity markets with their widely diversified assortment of investments.

In the United States individual retail traders must buy and sell on the Forex Currency Market through a broker registered with the CFTC – the Commodity Futures Trading Commission.

The broker of choice should also be a member of the voluntary National Futures Association (NFA). Forex brokers work with retail trader clients using an online platform that provides both a learning and research tool and a trading mechanism.

The speculative trades that make up most of the Forex market’s volume are all made with the expectation that the currency bought, or sold will increase/decrease in value in comparison to the other currency that it is paired with.

Although, it has become easier now to be involved with currency market exchange, the trading itself comes with various risks. The many variables that come into play when judging currency values creates a much different arena than the Equity markets. This makes it vitally important to work with a reputable and knowledgeable Forex broker.

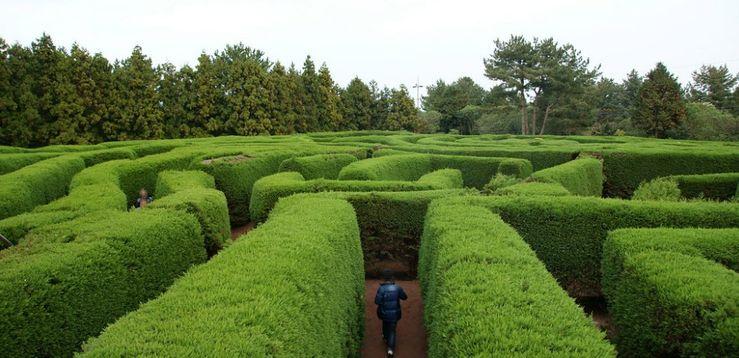

For the complete beginner, however, this Market can be a maze of pitfalls designed to help you lose your shirt. The stories are easily found all over the Internet relating how newbies lost everything. One man lost a huge chunk of money due to inappropriate management of the leverage offered on forex currency trading. Another relied heavily on the forex signal service, which have claimed it is 100% accurate, but lost everything in one transaction. A search on any search engine will pull up dozens of these tales of woe. The message is clear, don’t try to speculate in currencies, unless you are an experienced trader!

Please also read: Busting The Myth Of A FOREX Market Maker

Then again, if other Forex traders can do it, with enough research and skill, perhaps you can too. There is no doubt that some people make a living trading on this Market. Approximately 10-20 % of traders are making money. That leaves 8 out of 10 in the cold, but if you feel you have what it takes, make sure you do the research, get a platform that offers excellent customer service, and avoid “trading greed,” which will invariably lead you to bad investment choices.

As you may have understood, the forex currency trading interests many people, but they may find it unfamiliar due to its difference from other markets, commissions, technical jargon and its speculative nature among other things. However, with the right guidance, anyone can successfully trade in currency market exchange and avoid making costly mistakes that have led many to shy away from trading the currencies.

When seeking to trade forex the right way, it is important to know much about the trade and know the answers to the questions that most people ask about the market. The questions that people often ask include the following…

Which Currencies do People Trade in Forex?

The main currencies traded in forex are the world’s most liquid currency pairs. The four major currencies are the Euro/US dollar; US dollar/ Japanese Yen; British pound/ US dollar and the US dollar/ Swiss franc (CHF). The three commodity pairs are Australian dollar/US dollar; US dollar/Canadian dollar and the New Zealand dollar/ US dollar. These currency pairs in addition to other various combinations such as GBP/JPY, EUR/GPB and EUR/JPY account for more than ninety-five percent of the speculative trading that happens in Forex.

Who are the Participants in Currency Market Exchange?

Commercial, Investment and Central Banks have dominated the forex market, but other participants are joining the market rapidly. They now include brokers, international money managers, registered dealers, multinational corporations, private investors, options and future traders.

In What Way is Forex Currency Trading Different from Other Markets?

Forex differs from other markets such as stocks, options and futures in that no central government controls it, the lack of clearing houses to guarantee the trades and the lack of an arbitration panel to adjudicate disputes. All the Interbank members in forex market trade with each other based on their credit agreements.

This arrangement works well because forex trade participants must cooperate with and compete against each other. This brings about self-regulation, which provides the market with an effective control. In addition to this, the reputable retail forex brokerage houses in the U.S. have to join the National Futures Association (NFA). When they join NFA, they agree to abide by certain arbitration in case of any dispute. It is, therefore, essential for retail customers who wish to trade currencies to use the services of NFA member firms.

Forex trading also differs from other markets because there is no limit to the amount of money that one can trade. Forex often lacks gaps in price and trades for nearly 24 hours each day.

Where is the Currency Market Exchange Commission?

The forex market lacks commissions because unlike markets based on exchange, Forex is a market based on principals only. Retail firms that are trading in currency market exchange are dealers but not brokers, and they take market risk by being counterparts to the investor’s trade. The most firms do not charge commissions, but make profits by utilizing the bid-ask spread instead.

What are the Issues that Affect Currency Prices?

A variety of political and economic conditions affect currency prices and the most important are political stability, interest rates and inflation. In addition, governments at times trade in the forex market so that they can influence their currency‘s value. They can either use their domestic currencies to flood the market to cut the price, or purchase currencies in large numbers to increase the price. This is what forex traders refer to as central bank intervention.

What are some of the tools needed to start forex currency trading?

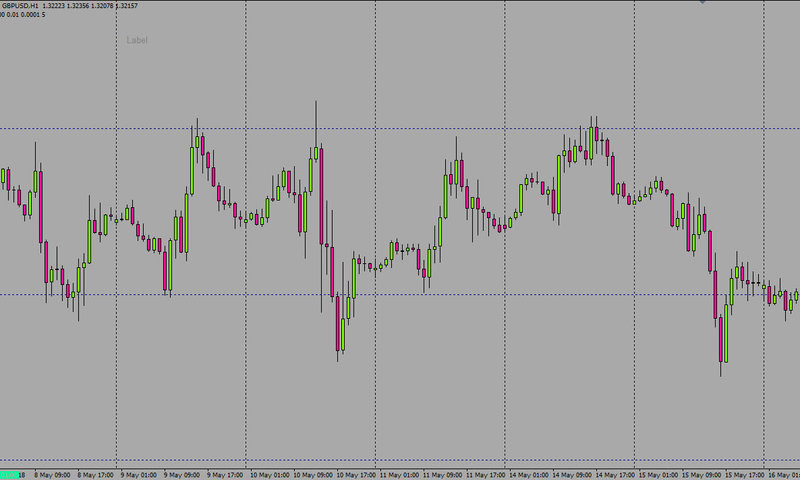

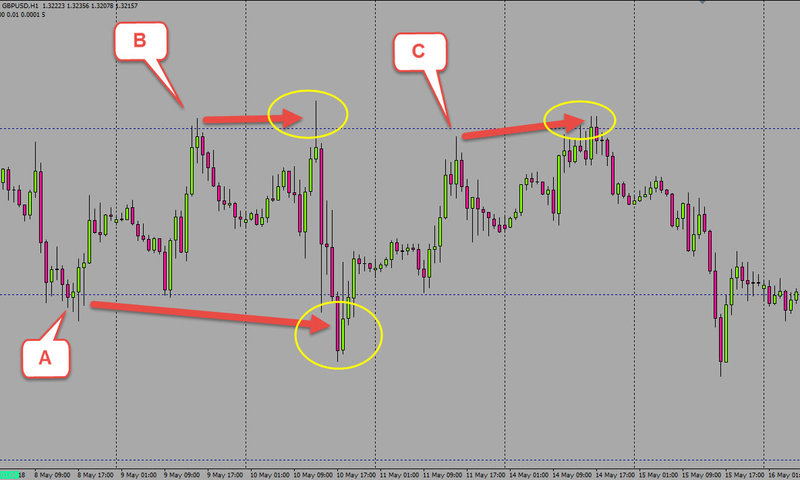

Trading platform and charts:

This one is a no-brainer! Obviously, you need a trading platform and charts, to speculate in the markets. However, you need the correct charts, and not just any charts. Meaning, you need to find a Broker that has the New-York closing charts. The daily closing time of the candle, or the bar, should reflect the New-York closing time.

The reason, the end of the trading Day of the FX market falls at five pm NY time. Actually, it is couple seconds before the five pm, and the start of the new trading Day is marked at exactly the five pm, or 17:00 (military time).

The New-York close also signals the end of one the most actively traded session – the U.S. session. This is an important piece of information, because if you aren’t analyzing the right technical charts, you don’t understanding of what is developing in the market.

The FX Calendar:

This is another very valuable tool. As a trader, you want to be aware of the fundamental developments in the Forex marketplace.

The calendar shows the upcoming economic events along with all the economic news that are scheduled for each of the currencies. It also shows their previous as well as expected values.

This is how the calendar works; as soon as the news event hits the market, the calendar starts to update (in some cases, with a delay) to reflect the correct numbers. Big market moves happen during major economic releases, especially if the projected numbers beat the expectation by a huge margin.

Correlation Matrix Tool:

Before explaining this topic, lets answer the question: “What is the correlation in FX market, in the first place?” In the nutshell, it is the relation of price changes in one currency in comparison to another one.

The correlation matrix tool helps to see these related changes in currency pairs that move in tandem.

With this tool one can avoid opening trades on pairs that move in the same direction.

This helps tremendously, to reduce double losses and trading margin locking with the trading instruments that are expected to behave the same way. Basically, the tool helps to avoid speculating the currencies with the same level of correlation.

Capital:

Ahh, this one… I’ve almost forgot…

Yes, in order to trade you need – Money!

Your trading success will be measured in dollars, so you need lots of them. If you think, you’ll be able to achieve any level of success with just the lousy thousand bucks, you are completely delusional! No pun intended. You need a solid bankroll, especially for the folks in the United States and Japan, for the decreased leverage reason. Without the capital no real-world trading is possible.

Sure, one can trade with the virtual money, but without the real emotional commitment. I’ve seen traders doing really well with the demo accounts, and once they’ve moved to the real deal, they’d blow it all away. The reason, no real-world experience! Bottom line, you need capital and you need to look after it like a hawk with proper risk management.

Hardware & Accessories

If you are serious about trading, then you’ll need a powerful hardware; a desktop, or at least a laptop. The good thing about the desktop is that it has bigger screen which gives you a better view of the charts. On top of that, desktops usually are tougher (longer life span) than laptops and have more capacity for speed.

Desktop: CYBERPOWERPC Gamer Xtreme

# Has huge storage capacity – 1TB hard drive

# Powerful processor with Turbo Boost

# Speed is a major factor when it comes down to parsing data from numerous sources, so this one comes with 8GB RAM with Intel B360M Express chip-set and with 120GB SSD.

Laptop: Acer Predator Helios 300

# 7th Generation Intel Core i7 Processor

# Turbo Boost Technology

# NVIDIA GeForce GTX 1060 with 6 GB of GDDR5 VRAM

This one is a high-quality gaming laptop with a long battery life. Premium Feel, very portable which allows you to be more, or less mobile with your trading. If you travel a lot, or if you simply don’t like to be chained to one place this is one a decent choice. I mean, it’s not an ultra-thin notebook, but it is very travel friendly. Insane performance per dollar spent!

Computer Glasses by Gunner:

Very underestimated trading accessory! Seriously, your eyes are probably the most important thing other than your trading capital. There are so many ways one could get the trading bankroll, but there are none for the precious eyes! If you lose your sight, you’re done – you can’t trade, yet alone do anything in life.

If you think, this is not a big deal, please go on and try to stare at monitors 6 to 10 hours a day, every day, then see what happens in about 3-5 years…

Get the Gunner gaming glasses and protect yourself, right from the beginning!

The glasses help, immensely, to reduce the eye fatigue, so you can be at the computer long enough to hunt down the trading opportunities.

What Resources do I need when starting forex currency trading?

Babypips is one of the best sites to learn about Forex trading for complete beginners. They have courses that will give you a good understanding of the basics, terminology, and mechanics of Forex trading. Babypips also offers their School of Pipsology, which, in a nutshell, is an online trading course, offering a bit about everything forex related.

The site has been around for a long time and lots of newbies flock there for the education. Again, let me reiterate, it’s geared completely towards beginners. The whole site is fun to read, because it’s been written in non-academic manner. On top of that, when things are free, like with Babypips, you don’t lose out on education.

Forexfactory is an online site, as well as an open forum for traders from around the world.

It is the best online stop for forex speculators. It has gathered a lot of very smart traders and is the best online place to up your game. Whether, it is day, or night, there will be literally thousands of traders online at any given time. The forum has enough trading systems to keep anyone busy for a very, very long time. Here is the thing, if you are one these, forex junkies that like reading about trading strategies and systems, then this is the right place for you! Just by reading through all the systems it will probably take you gazillion days, which is a lot.

Forexfactory has become an essential place for traders who want to take their forex currency trading at another level. In my opinion, Forexfactory has probably the best FX news calendar compared to others, which by the way is completely free.

The truly awesome thing about the economic calendar is that a trader can see the high impact news that are scheduled to be released on a certain date in the future, as well as, the news that had been released in the past. You can back test the strategy to see how it has performed during the news release. The site is also pretty good for checking up on Brokers, if you’re looking for the decent one.

When it comes to airing the relevant trading information, this site has been the go-to-hub for professional and retail traders since its inception. The folks at ForexLive are driven by the belief that all traders need pertinent and on-time trading information, which they have been delivering every trading hour.

The company has, perhaps, the fastest team of currency analysts from anywhere. ForexLive doesn’t bring just every headline that is out there, it supplies the headlines that really matter to traders. Most importantly, they explain why it should matter. Their analysts are very knowledgeable and diligent. This is the reason why, speculators from around the globe, turn their attention to them, when trading.

They deliver an outstanding media coverage, which is so vital, when speculating in the currency markets. Forexlive analysts react very quickly to ever-changing news releases and provide their objective information in a timely manner. Rest assured, you will be interacting with a team of experienced traders when using this site!

Check this topic: How Knowing About The Stop Hunting Forex Can Make You A Better Trader

Ok, these were some of the basic questions that need answering when thinking of trading foreign currencies.

Well, with the high level of risk and the many technical and fundamental skills needed to execute profitable trades, the question may be asked, “Why even bother with forex trading, with all the high risk involved?”

The answer is simple, forex can be extremely profitable if you are well-informed and take the time to learn it. In addition, many people are looking for that niche that will help supplement the income and the currency market exchange provides the foundation towards building that niche.

Even if someone has never traded a day in their life, Forex Currency Trading provides enough general information that will help anyone have a fair shot at making money. By following a few simple steps, one can begin learning a new skill that may lead them to financial freedom.

There are numerous success stories that can be learned from. In order to belong to the success group, it has been widely said that one of the most important things to do when beginning, aside from going in with the proper education, is to treat it as if it was your own business.

Do not go into the forex currency trading with the mindset that it is a hobby, or a game!

You must be a complete professional and make valuable use of your time. In recent reports, some of the most successful forex traders, who consistently make 30-40% annual returns on their investment, now hold, or once held a full-time job while they were trading. They were merely using it as a tool to help supplement their income while at the same time treating it in the most professional way, not treating it as a game. So, it is vital to learn how to trade Forex the right way, and be well-prepared before even considering your first trade.

The Forex Trading Mistakes

When attempting the forex currency trading, some people make mistakes that cost them a lot of money. It is essential to know the most common mistakes made and how to avoid them.

The first mistake is using too much leverage. This is when a trader has a small account balance, but makes a big trade. If the market moves against the trader’s position by a small amount, the trader will suffer large losses.

The other common mistake is over trading. This involves traders looking for absent trading opportunities. New traders make this mistake because their main aim is just to trade and this leads to a poorly executed trade that brings losses.

Another mistake that new traders often make is picking tops and bottoms. They try to tell where currency pairs will turn around at and start moving in the opposite direction, which is difficult for professional traders too.

Traders also often make the mistake of thinking that forex currency trading will bring them quick profits. Now, it is important to note that for Big players that influence this market, Forex falls into a type of a long-term Investment. The Institutions realize, a trader can have positive and negative months. Good traders should have more months and even quarters that are positive.

Jumping from one strategy to the other is most widely mistake that forex traders make. Therefore, it is important to note that it takes time to develop a certain strategy and personalize it. Once a trader does this, he or she can adapt it to changing market conditions so, sticking to one strategy is the best idea.

The other common mistake that traders make is lacking of a stop-loss. It is important for a trader to have a clear exit strategy when entering into a trade. One should decide how many pips he or she is looking for and limit the loss that one is able to bear. If the loss limit is fifty pips, a trader should set his, or her stop-loss to get out of the trade automatically when one loses that particular amount.

To Conclude:

The currency market exchange is a lucrative marketplace, but not without proper research and education. There are too many variables for not to properly learn the techniques, yet Forex goes out of its way to assure that anyone is capable of becoming a successful trader. A person’s success will greatly depend on the amount of effort exerted.

Profitability can be achieved with proper education and with the right expectation. When going into forex currency trading with your eyes wide open, as opposed to your eyes wide shut, and with the proper set of rules, training, motivation, learning to execute the correct trades at the correct time, forex trading can and will be an extremely profitable venture.

Remember, knowledge is power in all things, and all things can be accomplished through knowledge. With the right guidance and with proper knowledge, traders can highly succeed in forex trading.