When it comes to forex trading, one of the most critical decisions traders face is determining the ideal duration to hold a position. The answer to, how long should I hold a forex trade can directly influence your overall success and risk management in the volatile forex market.

Trade duration can shape your strategy, affect your profit potential, and determine your exposure to price fluctuations. Whether you’re a day trader looking for quick moves, a swing trader riding trends over a few days, or a long-term investor targeting major economic cycles, understanding the best timeframes for holding trades is essential.

Knowing how long to stay in a forex trade goes beyond waiting for a profit target or a stop-loss level. It involves analyzing market conditions, understanding trading psychology, and aligning your trading plan with realistic goals.

In this article, we’ll explore the factors that impact the ideal holding period for forex trades, from market volatility to strategy types, and give you a comprehensive guide to making informed choices about trade duration.

How Long Do You Stay in a Forex Trade?

Factors That Determine the Duration of a Trade

The duration of time you hold a forex trade depends on several factors. Key among these are your trading goals, your approach to risk management, and your analysis style.

A trade’s duration is often tied to whether you’re aiming for short-term gains or long-term returns. Shorter trades typically prioritize quick profits, often requiring meticulous timing, while longer trades can ride broader market trends but expose traders to prolonged risk.

Another crucial factor is the size of your capital. Smaller accounts tend to favor shorter trades because they carry less overnight risk and can manage leverage more effectively.

In contrast, larger accounts might accommodate longer trades due to greater resilience against short-term fluctuations. Additionally, a trader’s “psychological makeup” plays a crucial role; high-stress tolerance often suits longer trades, while a need for immediate feedback aligns with shorter trading styles.

Trading Strategy: Scalping, Day Trading, Swing Trading, and Position Trading

Your trading strategy dictates your holding period.

Let’s examine how each strategy affects trade duration:

Scalping

Scalping is ultra-short-term, often lasting seconds to minutes. Traders here aim for tiny profits across many trades. It requires high concentration, quick execution, and a well-planned exit strategy to mitigate losses from rapid market moves. Scalping suits highly liquid markets like forex & futures, where spreads are narrow.

Day Trading

Day traders close all positions before the market closes, avoiding overnight exposure. This style involves holding trades for a few minutes to several hours, allowing traders to profit from intra-day movements.

Day trading is popular among those with enough time to monitor charts throughout the day. You have to be present at your trading desk, sort of “glued” to the computer, the whole day. It’s like a day job but with a much better payout.

Swing Trading

Swing traders hold positions for a few days to weeks, capitalizing on medium-term price trends. This approach requires less monitoring than scalping or day trading, making it suitable for part-time traders. Swing trading often considers both technical and fundamental analysis.

Position Trading

Position traders hold trades for weeks, months, or even years. This long-term strategy relies heavily on fundamental analysis. The aim is to capitalize on significant trend changes. Position trading involves the least amount of monitoring, as it seeks to avoid minor fluctuations in favor of substantial movements over time.

Market Conditions and Volatility

Volatility can significantly affect how long you hold a trade. High volatility periods may prompt traders to either shorten or extend their holding periods based on increased risks and opportunities.

For instance, in low-volatility markets, traders may choose to hold long-term positions due to a slower pace of price changes. Conversely, during high volatility events like central bank announcements, a day trader might hold onto a position longer if it aligns with an unexpected price move or quickly exit to protect gains.

Seasonality also impacts market conditions; certain times of the year (e.g., end-of-quarter or holiday seasons) exhibit unique volatility patterns. Recognizing these conditions helps traders adjust their timeframes and plan exits more effectively.

Timeframes Used: Short-Term, Medium-Term, Long-Term

Timeframes also shape trade durations. For example, short-term traders generally focus on timeframes under 1 hour (such as 5-minute or 15-minute charts), medium-term traders utilize daily or 4-hour charts, while long-term traders analyze weekly or monthly charts.

Each timeframe reflects different levels of commitment and patience; short-term charts demand constant monitoring, while longer-term charts provide broader trend insights, reducing the need for frequent adjustments.

Examples of Different Trade Durations for Each Strategy

Scalping: A trader might open and close a EUR/USD trade within 30 seconds, aiming to gain 1-3 pips.

Day Trading: A USD/JPY day trade might last 2-3 hours, targeting 20-50 pips on a price breakout.

Swing Trading: A swing trader could hold an AUD/USD position for a week, banking on a significant trend continuation.

Position Trading: A position trade on GBP/USD could span several months, anticipating a major economic shift such as a central bank policy change.

How Much Time Is Needed for Forex Trading?

Active Trading vs Passive Trading

Active trading, as seen in day trading and scalping, demands daily involvement and fast decision-making. Traders must constantly analyze and respond to market conditions. Passive trading, such as position trading, involves less frequent analysis and trade adjustments, focusing on long-term market movements.

In active trading, time spent can directly correlate with potential profits or losses. Passive traders, on the other hand, spend more time on in-depth analysis but may hold trades for extended periods with minimal intervention. Both styles require time but differ significantly in daily commitment and psychological demands.

The Daily Commitment to Different Trading Styles

Different trading styles demand varying levels of daily commitment:

Scalping

Scalping requires intense focus over short timeframes. Scalpers typically trade for 2 to 4 hours, executing dozens of trades within that period.

Day Trading

Day traders need to dedicate several hours daily to analyzing charts, news, and executing trades. Many day traders spend 4-8 hours actively trading overlapping sessions.

Swing Trading

Swing traders often spend about 1-2 hours per day monitoring positions and making adjustments. They typically have the flexibility to skip days if no setups align with their strategy.

Position Trading

Position traders can spend as little as a few hours per week or month conducting research and reviewing open positions.

Time Management for Part-Time vs Full-Time Traders

For part-time traders, time management is crucial. Scalping and day trading may be challenging for those with other commitments, as these styles require consistent attention. Part-time traders may find swing trading or position trading more feasible as they demand less daily involvement.

Full-time traders, on the other hand, may engage in multiple strategies and allocate several hours each day to market analysis, trade execution, and reviewing performance. Full-time trading offers more flexibility but also requires rigorous discipline and mental endurance.

Does More Time Equal Better Results…

Spending more time on forex trading does not necessarily yield better results. Quality over quantity is essential; traders must focus on robust strategies, market analysis, and emotional control rather than solely increasing their screen time.

Traders who dedicate time to improving their skills and learning from mistakes are more likely to succeed. Some traders make a handful of quality trades each week, while others rely on frequent trades. Both approaches can be profitable if managed well, but time alone won’t guarantee success.

When Should You Exit a Forex Trade?

Exiting a forex trade effectively can be as vital as entering at the right moment. Knowing when to close a position helps lock in profits or minimize losses. Here are some critical indicators and strategies to guide your exit decisions:

Technical Indicators for Exits: Standard Deviations from the Mean and Fibonacci Extensions

One popular technical approach to identifying exit points involves using indicators like standard deviations and Fibonacci extensions.

Standard Deviations from the Mean: This indicator, often employed with Bollinger Bands or Average True Range (ATR), helps traders identify overbought or oversold conditions. The upper and lower bands represent levels that are two standard deviations away from the moving average.

When price action hits these outer bands, it indicates that the asset is reaching extreme conditions. For instance, a trade that reaches the upper Average True Range band suggests the market is overbought, potentially signaling an ideal point to exit or take partial profits. Similarly, hitting the lower band might indicate an oversold condition.

Fibonacci Extensions: These extensions are derived from Fibonacci retracement levels, allowing traders to predict potential support and resistance levels for future price movements. When a price moves significantly in one direction, Fibonacci extensions (like 161.8% or 261.8%) can indicate where the price might experience resistance or support. If a trade nears these levels, it can signal a high probability of reversal, making it a strategic exit point.

Fundamental Factors that Signal an Exit: Economic News and Geopolitical Events

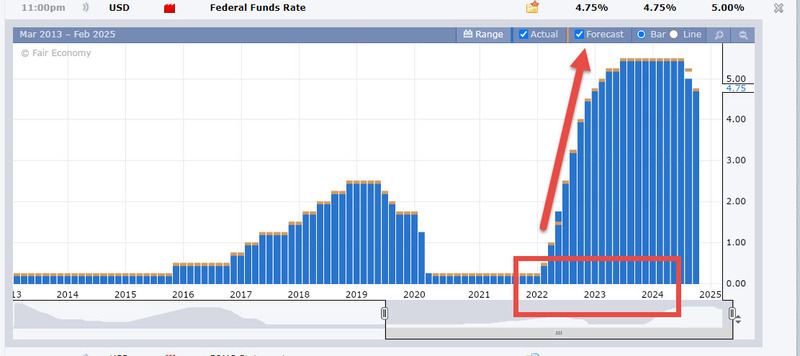

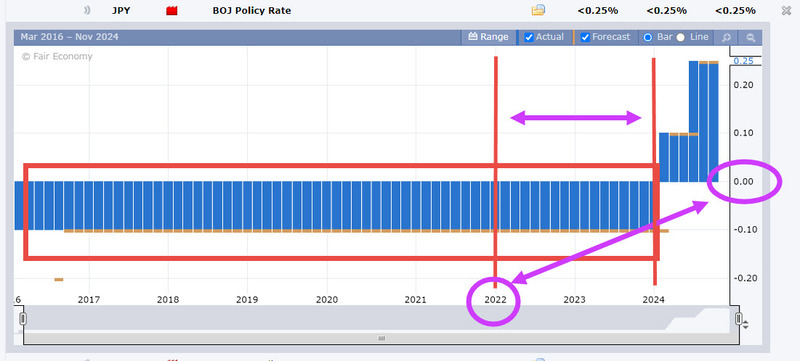

Fundamental analysis can provide crucial information for trade exits. Major economic releases, such as interest rate decisions, non-farm payroll reports, or inflation data, often cause market volatility.

For example:

Economic News

Significant economic events like GDP reports, employment figures, or central bank meetings can create substantial price swings. An unexpected interest rate hike or cut could reverse the direction of a currency pair swiftly. If a trade’s profit target is close, it might be wise to exit before the release to avoid the volatility that could erode gains.

Geopolitical Events

Political instability, elections, trade agreements, and conflicts can dramatically impact forex prices. For instance, a sudden diplomatic crisis might drive investors to safer currencies, like the U.S. dollar or Japanese yen. Traders should watch the news for signs that such geopolitical factors could disrupt the market and consider exiting to protect their capital.

The Importance of Setting Stop-Loss and Take-Profit Levels

Setting stop-loss and take-profit levels is essential in forex trading to manage risk and enforce discipline.

Stop-Loss Levels: A stop-loss order closes a trade at a pre-determined loss level, limiting the downside risk. Setting a stop-loss ensures that emotions don’t overtake rational decision-making. Traders can manage risk more effectively by determining an appropriate stop-loss level, often based on a percentage of account capital or price levels like recent support and resistance. This approach allows them to limit losses without the need for constant market monitoring.

Take-Profit Levels: Just as stop-loss levels protect against losses, take-profit levels lock in gains at pre-determined points. Take-profit orders close a trade once it reaches a targeted profit, ensuring that profits are secured without requiring constant market monitoring. The key is to set a realistic target that aligns with the trade’s strategy and analysis.

Psychological Aspects: When Emotions Dictate an Exit vs. Rational Analysis

Psychology plays a huge role in trading. Fear and greed often lead traders to exit trades prematurely or hold onto losing trades. Here’s how to keep emotions in check:

Emotional Exits

Emotional trading happens when fear, impatience, or overconfidence drive exit decisions rather than data and analysis. For example, if a trade goes into a slight loss, fear might push a trader to exit prematurely. Alternatively, greed might encourage a trader to hold a position longer than planned, hoping for additional profit, only to see gains diminish.

Rational Exits

A rational exit is planned and based on pre-set conditions, whether technical, fundamental or through a pre-established exit strategy. Using these criteria helps avoid impulsive decisions, sticking to the analysis instead of reacting to price fluctuations emotionally.

How Long Can I Hold My Trade?

The length of time you hold a forex trade varies widely depending on your trading strategy and goals. From quick scalping to long-term positions, each approach has its benefits and risks.

Overview of Trade Durations for Different Strategies (Scalping, Swing, Day Trading, etc.)

Different trading strategies require different holding times:

Scalping

Scalpers hold trades for seconds to minutes, aiming for small gains from tiny price movements. This style is intense and high-frequency, where trades are exited quickly to capture small profits.

Day Trading

Day traders hold trades for a few hours, entering and exiting within the same trading day. They aim to profit from intraday price movements without the risk of overnight exposure.

Swing Trading

Swing traders hold positions for days or weeks, profiting from short-to-medium-term trends. This style requires patience and a willingness to withstand market fluctuations.

Position Trading

Position traders take a longer view, often holding trades for weeks, months, or even years. Their analysis is based on long-term trends, with minimal attention to short-term volatility.

The Benefits of Holding Trades for the Long Term

Holding trades for an extended period can have several advantages, especially when the market aligns with the trader’s analysis.

For example:

Trend Amplification

Longer-term trades allow FX participants to benefit from extended trends. When the price moves in the trade’s favor for weeks or months, these profits can accumulate significantly.

Lower Transaction Costs

Trading less frequently helps reduce transaction fees and spreads, which can add up with high-frequency strategies.

Avoiding Market Noise

Long-term positions are less affected by short-term market fluctuations, as they focus on larger trends, helping traders avoid overreacting to minor price swings.

Risks of Overextending or Holding Trades Too Long (Swap Rates, Overnight Fees)

While there are benefits to holding trades longer, there are risks to consider as well.

Swap Rates and Overnight Fees: Most brokers charge swap rates, or rollover fees, for positions held overnight. These fees can accumulate significantly if the trade remains open for a long time. Swap rates vary depending on the currency pair and the broker, making it essential to check these costs if planning to hold a trade for more than a few days.

Market Reversal Risk: The forex market is volatile, and holding a trade for too long can expose it to unexpected price reversals. The trade may turn against you due to changes in market sentiment, economic indicators, or geopolitical events.

Overextension: Overextending a trade, especially one that shows small losses, may lead to substantial drawdowns, affecting both account equity and trading psychology. If holding a trade becomes more about hoping for a recovery than about following a strategy, it’s a sign of overextension.

By understanding the time frame that aligns best with your trading style, you can more effectively balance the rewards and risks, using a well-rounded approach to forex trading that maximizes your strategy’s potential.

Can I Hold Forex for Months?

Holding a forex position for several months requires a specific approach that takes into account both potential long-term gains and the added complexities of extended exposure to the market.

Long-term positions demand thorough Macro-Fundamental analysis, patience, and strategies tailored to the unique aspects of forex trading. Here’s a closer look at what to consider if you’re thinking about holding a forex position for months at a time.

Holding Forex Trades for Long-Term Positions

Long-term forex trading, often referred to as position trading, involves keeping a position open for weeks, months, or even years. Position traders typically focus on economic trends and macro-fundamental data that affect currency prices over time, such as interest rates, economic growth rates, and political stability. Long-term traders are less concerned with daily fluctuations and more focused on the overarching trends that drive currency movements.

For example, a position trader might take a long position on a currency pair when they anticipate a strengthening trend based on long-term economic data, like consumer confidence, low unemployment, consistently high GDP growth rate, or a period of monetary tightening.

This approach is best described in the movie “The Big Short.” It requires patience, as profits or losses may not materialize for some time, and success often depends on the trader’s ability to ignore short-term market noise and focus on long-term trends.

Impact of Swap Rates and Rollover Fees on Long-Term Positions

One major consideration for long-term forex traders is swap rates (also known as rollover fees). These fees are applied to positions held overnight, covering the interest rate differential between the two currencies in the pair. Depending on the broker and the specific currency pair, these rates can either work for or against a trader.

Positive Swap Rate: If the interest rate of the currency you are buying is higher than that of the currency you are selling, you may receive a positive swap rate, meaning you’ll earn a small amount for holding the position overnight.

Negative Swap Rate: Conversely, if the currency you are buying has a lower interest rate than the one you’re selling, you’ll pay a fee for each night the position is held.

Over several months, these fees can add up substantially, potentially eating into profits or exacerbating losses. As such, it’s important to check swap rates and factor them into your long-term strategy.

In some cases, traders even structure their trades to benefit from positive swap rates, known as a carry trade strategy, where they focus on currency pairs with favorable interest rate differentials:

Case Studies: Long-Term Traders and Their Strategies

Examining how successful long-term forex traders operate can offer insights into effective strategies for extended holding periods.

Here are two common approaches:

Fundamental-Based Strategy

This strategy focuses on the economic and political factors that influence currency valuations. For instance, a long-term trader might go long on a currency if they expect its economy to outperform others due to robust GDP growth, a steady job market, or rising interest rates. They may keep the position open for months or even years as long as their macro-fundamental analysis supports it.

Technical and Trend-Following Strategy

Some traders use technical analysis to identify and follow long-term trends. By employing tools like moving averages and trend lines, these traders enter positions that align with the prevailing trend, holding them until signs of a reversal appear.

For instance, if a currency pair has been in a prolonged uptrend, a trader might hold the position as long as the price stays above a specific moving average, such as the 200-day moving average, and exit only when signs of a downtrend emerge.

These case studies show that long-term forex trading isn’t about guessing short-term moves but rather about identifying longer trends and aligning with the economic and technical indicators that support the trade.

Benefits and Risks of Holding Trades for Several Months

Long-term forex trading offers unique advantages but also carries certain risks.

Benefits:

Reduced Trading Frequency

Long-term trading requires fewer trades, which can reduce transaction costs and avoid overtrading. This approach is ideal for traders who prefer to analyze the market less frequently.

Capitalizing on Major Trends

Holding a trade for an extended period allows traders to benefit from large price movements that unfold over time, maximizing potential gains if their analysis aligns with market movements.

Less Stress from Daily Fluctuations

Long-term trading minimizes the stress associated with daily price swings, as the focus is on longer-term movements rather than intraday volatility.

Risks:

Exposure to Swap Rates and Rollover Fees

As previously discussed, swap rates can accumulate significantly over time, potentially cutting into profits. Negative swaps, in particular, can erode gains, making it essential to monitor these rates and consider them in your position sizing.

Increased Sensitivity to Economic Shifts

Long-term trades are exposed to broader economic changes, which can introduce volatility. A sudden policy shift, for instance, could reverse a long-held trend, impacting the profitability of a trade.

Capital Tie-Up

Holding a position for several months means capital is committed to that trade, which may limit flexibility and reduce opportunities to participate in other trading opportunities during the period.

Long-term forex trading is a methodical approach that demands planning, discipline, and a willingness to tolerate market fluctuations while aiming for massive gains over time.

By understanding how swap rates work, utilizing effective strategies, and weighing the potential benefits against the risks, forex traders can effectively determine if long-term holding suits their financial objectives and trading approach.

Conclusion

Knowing when to exit a forex trade and how long to hold a position is crucial for success in the forex market. These decisions require a combination of technical analysis, fundamental insights, and psychological discipline to ensure trades are managed effectively and with confidence.

Exit strategies should be based on technical indicators such as standard deviations and Fibonacci extensions, as well as the impact of major economic and geopolitical events. Understanding these factors helps to determine the right time to close a position.

The length of time you hold a trade depends on your trading style—whether it’s scalping, day trading, swing trading, or position trading. Each style comes with its own set of time frames and risk considerations, so it is essential to choose an approach that suits your goals, risk tolerance, and market outlook.

For those considering holding forex positions for months, it is important to evaluate both the rewards and risks of long-term trading. Swap rates, rollover fees, and changes in market dynamics can influence profitability over time.

Yet, with a well-structured long-term strategy and an understanding of the risks involved, holding forex positions for extended periods can lead to significant returns.

In short, there is no universal answer to when to exit or how long to hold a forex trade. The key to success lies in thorough preparation, solid analysis, and a strategy that fits your personal trading objectives.

By balancing technical and fundamental factors with disciplined risk management, traders can make informed decisions that foster consistent growth and long-term success in the forex market.