A Global Macro Hedge Fund can best be identified through the use of funds in active management, in attempts to profit from broad market fluctuations resulting from Economic or political events.

Let’s break down the Global Macro Hedge Fund as it consists of two meanings: Global Macro as a strategy, and Fund as a partnership.

Below we get to see both of which build up its meaning.

Simply put, Global Macro is an investment strategy that seeks to make profits from the prediction and interpretation of large-scale economic and political events.

A very memorable example of what is now recognized as a Global Macro strategy was, when George Soros shorted (sold) the British Pound in 1992, just couple months before, known now, as the “Black Wednesday.”

While a Hedge Fund, on the other hand, is an investment partnership between a fund manager, often known as the general partner and the hedge fund investor, often identified as the limited partner; with the sole purpose of maximizing returns.

Global Macro Hedge Funds came to being as investors sought to make money regardless of rising or falling currencies, commodities, equities or futures markets.

The term “hedge fund” comes from risk hedging techniques that these entities were initiating on their existing positions, both, long and short.

Nowadays the types and nature of the hedging tactics enhanced, as did the various types of investment assets.

It is safe to say, modern-day hedge funds participate in a diverse range of markets.

They employ a wide range of trading instruments, robust strategies, and sophisticated risk management techniques.

Note:

Hedge funds are commonly distinct from mutual funds, due to the fact that their leverage is not capped by the regulators. Furthermore, modern hedge funds are unique from private equity funds, given that, the greater number of these funds allocate their capital in comparatively liquid assets.

Check our Global-Macro compilations here >>>

Here is a small list of most successful Fund Managers:

Ray Dalio – (Bridgewater Associates)

George Soros – (Quantum Group of Funds)

John Paulson – (Paulson & Co.)

Paul Tudor Jones II – (Tudor Investment Corporation)

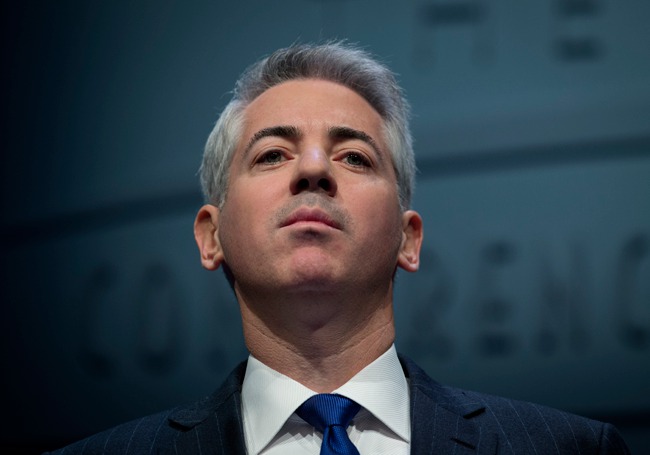

Bill Ackman – (Pershing Square Capital Management)

Paul Singer – (Elliott Management Corporation)

Here is the link to TipRanks.com to track Top 25 Hedge Fund Managers

Note: The list has been compiled in no particular order however, the Bridgewater Associates, is considered to be the world’s largest hedge fund firm with more than $150 billion assets under management.

Check our Global-Macro compilations here >>>

Types of Global Macro Strategies

A Global Macro Strategy is a set of approaches that bases its holdings, whether short or long positions in; equity, fixed income, futures and currency markets. The decisions to buy or sell the assets are based on political and economic views of various countries. There are three types of Global Macro Strategies.

A Global Macro Strategy is a set of approaches that bases its holdings, whether short or long positions in; equity, fixed income, futures and currency markets. The decisions to buy or sell the assets are based on political and economic views of various countries. There are three types of Global Macro Strategies.

Coming first we have the Discretionary Macro strategy; it deploys directional positions of an asset to express a positive or negative view on a market.

Secondly, we have a Commodity Trading Advisor (CTA) or Managed Future macro strategy; Similar to the Discretionary approach, but with different methodology. CTA’s make use of price-based and trend-following algorithms in trading.

Lastly, we have the Systematic Macro strategy; it’s a hybrid approach that makes use of both discretionary and CTA macro strategies in trading. The systematic global macro uses fundamental analysis analogous to that of discretionary macro, but with a systematic algorithm based approach of the CTA traders.

Be sure to also read:

Simple Logistics To Be Aware: Forex Fundamental Analysis

Global Macro Hedge Fund – the Pros and Cons

Global Macro Hedge Funds offer varying incentives, for one we have – the investors’ exposure to an aggressive investment strategy. The complexity of the tools used is all at the disposal of the investors. These strategies are deployed in nurturance of aggressive investment strategies. All with one goal, being able to yield more returns despite market fluctuations in any given period.

Secondly, Global Macro Hedge funds feature more stable gains. Through the various Global Macro Strategies, each one of them is designed and tailored for ensuring returns through expert analysis and forecasting of market changes Globally. Predictions of which quite generally create attractive investment opportunities, thus huge returns.

Thirdly, hedge funds cannot be advertised to the general public and, as such, are made available to certain sophisticated or accredited individuals. Meaning, you have to meet certain entry level requirements just to get your foot in with some of these Institutions.

As a matter of fact, in one of his interviews, Ray Dalio mentions that back in days you wouldn’t be able to do business with his Fund if you had less than 500 million dollars as an investment capital.

They also operate with greater flexibility than mutual funds and other investment funds. Most of them prefer to operate without direct regulatory oversight by bypassing licensing requirements applicable to investment companies.

As mentioned, a Global Macro Hedge Fund features extensive market knowledge, impeccable risk management techniques, and expertise in a particular asset class. That is probably why, hedge fund managers are handsomely rewarded for their knowledge in financial investments.

However, much as the advantages sound alluring, there are also as many disadvantages of which they have. The first, being that Global Macro Hedge Funds face critics heavily for their significant investment fees. Investors are charged a performance fee to motivate the managers, as well as a management fee.

Secondly, we get to see that with enormous leverage, that is the amount invested, also come massive losses. This also explains why some hedge funds end up in a bankruptcy.

Conclusion

Global Macro Hedge Funds can prove to be a complicated investment to pursue, as they are difficult to comprehend. This is partly due to the complex strategies employed, as well as, bad publicity by the media.

The truth is, hedge funds at times meet all expectations from attractive returns and performance, and besides the down times some have pretty stable returns. With the right education, familiarization and evaluation, there is a global macro hedge fund that fits the demands of every Investor.

However, with all that said, as is with everything else in life, caution is advised. As much as the advantages are attractive, the risk poses much of a threat, and thus investing in a Global Macro Hedge Fund should not be taken lightly.

What do You Think Of Hedge Funds?

Are they worth their salt…

Are Their Performance & Management Fees justifiable…

Please leave your comment below, and let us know.

Everyone loves what you guys are usually up too. This type of

clever work and reporting! Keep up the amazing works guys

I’ve you guys to my blogroll.