Within a dynamic market such as FOREX, understanding the principles of supply and demand is essential for traders seeking to navigate the complexities and unlock profitable opportunities. In this article, we will explore the concept of supply and demand in forex trading, delve into its significance, and address three major questions:

Does supply and demand work in forex?

We will explore the effectiveness of supply and demand analysis in the context of forex trading. By examining historical data, real-life examples, and we will demonstrate how supply and demand principles can be applied to “predict” market movements and generate profitable trades.

Is supply and demand trading profitable?

This question delves into the financial viability of supply and demand trading. We will examine the profitability of this approach by comparing it with other trading strategies, analyzing performance indicators, and highlighting potential risks and challenges. By presenting both the advantages and limitations, we aim to provide a comprehensive evaluation of the profitability of supply and demand trading in forex.

How to trade forex using supply and demand?

In this section, we will delve into practical techniques and strategies for trading forex based on supply and demand analysis. We will discuss key concepts such as identifying supply and demand levels, understanding price action and market structure, and incorporating technical indicators. Additionally, we will explore risk management strategies to optimize trading outcomes.

By addressing these three major questions, we aim to equip FX traders with a solid foundation in supply and demand trading, enabling them to make informed decisions and unlock profitable opportunities in the forex market.

Importance of Understanding Supply and Demand Dynamics

Supply and demand is a fundamental economic concept that applies to various markets, including forex. In the context of forex trading, supply refers to the quantity of a currency available in the market, while demand represents the desire of traders to acquire that currency. The interplay between supply and demand influences currency prices and determines market trends.

Understanding the dynamics of supply and demand is crucial for forex traders for several reasons.

Firstly, it helps identify areas of potential buying and selling pressure, known as support and resistance levels, respectively. These levels act as key reference points, offering valuable insights into possible price movements.

Secondly, supply and demand analysis enables traders to gauge market sentiment. By assessing the balance between supply and demand, traders can gain a deeper understanding of market psychology and make informed trading decisions.

Lastly, supply and demand dynamics contribute to the formation of market structures, such as trends, ranges, and consolidations. Recognizing these structures empowers traders to align their strategies with the prevailing market conditions, enhancing their chances of success.

Does Supply and Demand Work in Forex?

The principles of supply and demand are the cornerstone of market economics. In forex trading, these principles revolve around the interaction between buyers (demand) and sellers (supply) of currencies.

When demand for a currency exceeds its supply, its value tends to increase. Conversely, when supply surpasses demand, the currency’s value typically decreases.

Supply and demand levels are determined by various factors, including economic indicators, geopolitical events, central bank policies, and market sentiment. By analyzing these factors, traders can identify potential areas of supply and demand imbalances, which can offer valuable trading opportunities.

Applying Supply and Demand to the Forex Market

As discussed before, supply and demand analysis applies to all financial markets, including forex. In the forex market, supply and demand levels manifest as support and resistance cluster zones.

Support levels represent areas where buying pressure exceeds selling pressure, causing prices to reverse or stabilize. Resistance level, on the other hand, denotes areas where selling pressure outweighs buying pressure, leading to price reversals or consolidations.

By identifying these support and resistance cluster zones, traders can anticipate potential turning points in currency pairs and adjust their trading strategies accordingly.

Additionally, supply and demand analysis can help traders determine optimal entry and exit points, set profit targets, and manage risk effectively.

Factors Influencing Supply and Demand in Forex Trading

Several factors influence supply and demand in forex trading:

Economic Indicators: Economic data such as inflation rates, employment figures, and interest rates can significantly impact the supply and demand for currencies. Strong economic indicators often lead to increased demand for a currency, while weak indicators can soften demand.

Central Bank Policies: Decisions made by central banks, such as interest rate changes, quantitative easing, or tightening measures, can have a profound impact on currency supply and demand. Central bank announcements and monetary policy statements are closely monitored by forex traders.

Geopolitical Events: Political developments, trade agreements, and international conflicts can create shifts in supply and demand for currencies. Major geopolitical events can introduce volatility and uncertainty into the forex market, altering supply and demand dynamics.

Market Sentiment: Investor sentiment and market psychology play a significant role in supply and demand dynamics. Positive sentiment can drive demand for a currency, while negative sentiment can weaken it. Traders often assess market sentiment through various indicators, surveys, and news sentiment analysis.

To demonstrate the effectiveness of supply and demand analysis in forex trading, let’s consider a few case studies and examples:

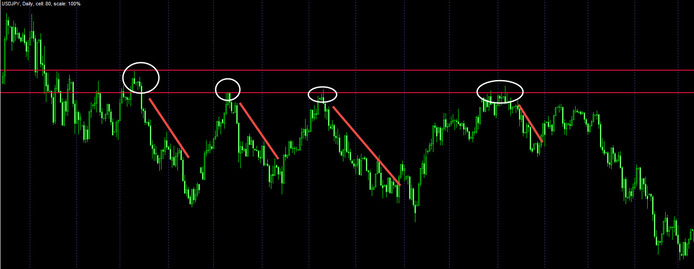

Example 1: USD/JPY Daily Chart

By identifying a strong resistance zone on the USD/JPY daily chart, a trader can anticipate a potential reversal or bounce in price. This knowledge allows them to enter short positions with a favorable risk-to-reward ratio, resulting in profitable trades.

Example 2: USD/JPY Weekly Chart

Analyzing the USD/JPY weekly chart reveals a prominent support zone. Traders can use this information to plan long positions, expecting a price reversal. Proper risk management techniques can be employed to protect against adverse market moves.

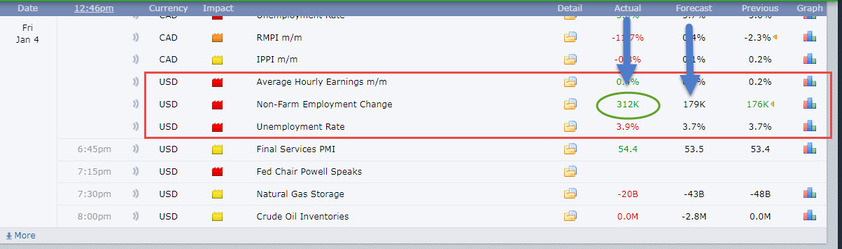

Example 3: Impact of Economic News

When a major economic news release, such as Non-Farm Payrolls (NFP), exceeds expectations, it can increase demand for the currency of the respective country. Traders who anticipated the positive economic outcome can capitalize on this increased demand and execute profitable trades.

These case studies and examples highlight how supply and demand analysis can be applied effectively in forex trading. By identifying key support and resistance zones and considering the influence of various factors, traders can enhance their decision-making process and capitalize on profitable trading opportunities.

It is important to note that supply and demand analysis in forex trading is not a foolproof strategy and should be used in conjunction with other technical and fundamental analysis tools.

Successful supply and demand trading in forex requires skillful interpretation of price action, market structure, and most importantly, the context behind the very same price action.

Traders need to continuously monitor the forex market, stay updated with relevant news and economic events, and refine their understanding of supply and demand dynamics.

Moreover, it is crucial to exercise proper risk management techniques when trading based on supply and demand analysis. Setting appropriate stop-loss levels, determining position sizes based on risk tolerance, and employing trailing stops (when necessary) on longer timeframes (H4-Daily-Weekly), can help mitigate potential losses and protect profits.

It is worth noting that supply and demand analysis can be subjective to some extent. Different traders may interpret support and resistance levels differently, leading to variations in trading strategies. Therefore, traders need to develop their trading plan based on their understanding of supply and demand dynamics and their individual risk appetite.

To recap, supply and demand analysis is a powerful method in forex trading that can provide valuable insights into market trends, support and resistance levels, and potential trading opportunities.

While it is not a guaranteed strategy, understanding supply and demand dynamics and incorporating them into a comprehensive trading approach can significantly enhance a trader’s ability to make informed decisions and achieve profitability in the forex market.

Exploring the Profitability of Supply and Demand Trading

The strategy is based on the principle that price levels are determined by the interaction between the supply and demand for a particular currency pair. By identifying areas of high demand (support clusters) and areas of high supply (resistance clusters), traders aim to make profitable trading decisions.

To evaluate the profitability of supply and demand trading, traders often rely on historical data and performance indicators.

By analyzing past price action and identifying key support and resistance levels, traders can gain insights into market dynamics. Additionally, performance indicators such as win rate, and risk-to-reward ratio can provide quantitative measures of success.

Comparison with Other Trading Strategies

Supply and demand trading is just one of many strategies employed in the forex market. When considering its profitability, it is essential to compare it with other trading strategies.

Different strategies have varying degrees of success depending on market conditions, trader skills, and risk management techniques. Traders should assess the strengths and weaknesses of supply and demand trading in comparison to alternative approaches to determine its profitability potential.

While supply and demand trading can be profitable, it is not without risks and challenges. One of the primary challenges is accurately identifying and drawing supply and demand zones.

“At the same time, in the age of technological advancements, drawing correct zones by hand is being replaced by custom-made indicators such as order-block; supply-demand; and support-resistance. There is a plethora of these indicators, both paid and free on the internet, for different platforms. All a trader needs is to test them and find which one draws the zones correctly and fits into their trading style.”

Despite the given choices, traders must develop a keen eye for interpreting price action and distinguishing valid zones from false signals. Additionally, market conditions, such as high volatility or sudden news events, can impact the effectiveness of this strategy. Risk management is crucial to mitigate potential losses and protect trading capital.

Traders Who Have Achieved Profitability through Supply and Demand Analysis

There are numerous success stories of traders who have achieved profitability through supply and demand analysis. These traders often highlight their ability to accurately identify key support and resistance levels, time their entries and exits effectively, and manage their risk.

While individual success stories can serve as inspiration, it is important to note that trading results vary from person to person.

“Since this method can be applied to different timeframes, anywhere from 1-minute and all the way up to Monthly charts, the profitability of this style of trading, as with any trading strategy, depends on a trader’s skills, experience, discipline, and adaptability to changing market conditions.”

In summary, the profitability of forex supply and demand trading is determined by various factors, including accurate analysis, effective risk management, and market conditions.

Traders should conduct thorough analysis, compare strategies, and be aware of the risks involved. Success stories can offer valuable insights, but it is essential to develop one’s skills and approach to achieve profitability in the forex market.

Identifying Key Supply and Demand Levels

Trading forex using supply and demand involves identifying key levels where the market exhibits significant buying (demand) or selling (supply) pressure. FX traders can identify these levels by looking for areas where price has previously reversed or consolidated.

The goal is to locate areas where an imbalance between supply and demand has occurred, indicating potential trading opportunities either for going long (buying) or for going short (selling).

Understanding Price Action and Market Structure

To effectively trade forex using supply and demand, understanding price action and market structure is crucial. Price action refers to the movement of prices on a chart, and market structure refers to the overall pattern and behavior of the market.

By analyzing price action and market structure, traders can gain insights into the underlying supply and demand forces and make informed trading decisions.

Implementing Support and Resistance Zones

As discussed before, support and resistance zones play a vital role in supply and demand trading. Support levels represent areas where buying pressure is likely to emerge, preventing prices from falling further.

Resistance levels, on the other hand, represent areas where selling pressure is likely to emerge, preventing prices from rising further.

“By accurately drawing support and resistance zones, traders can identify potential entry and exit points, simply because price tends to travel from one zone to another.”

Combining Supply and Demand Analysis with Technical Indicators

While supply and demand analysis can be effective on its own, combining it with technical indicators can provide additional confirmation and enhance trading decisions.

“Traders can use indicators such as; variations of Volume indicators, any type of oscillators (which are used extensively to confirm the strength or weakness of the levels), or trend lines to complement their supply and demand analysis. The key is to find indicators that align with the principles of supply and demand and closely relate to the trader’s overall trading strategy.

Most of the time the Volume and the oscillators are being used when price action trades in the supply or demand zones. Traders then check the indicators for clues such as; Volume divergence, and oscillator divergence to anticipate a bounce from the zone, deeper retracement, or a complete reversal off of the zone.”

Setting Entry, Stop-Loss, and Take-Profit Levels

Once key supply and demand levels have been identified, traders need to determine their entry, stop-loss, and take-profit levels. Entry levels are typically set near the zones where supply or demand is expected to be strongest.

Stop-loss levels are placed beyond the opposite side of the supply or demand zone to limit potential losses. Take-profit levels are established based on the trader’s desired risk-reward ratio or by identifying areas where the price may reverse (opposite side of the zone).

Risk Management Strategies for Supply and Demand Trading

Effective risk management is crucial when trading forex using supply and demand strategies. Speculators should determine their risk tolerance and set appropriate position sizes to protect their capital.

They can also employ techniques such as trailing stop-loss orders on higher timeframes, or scaling in and out of positions to manage risk. Regularly reviewing and adjusting risk management strategies based on market conditions and individual trading performance is essential.

In conclusion, trading forex using supply and demand involves identifying key levels, understanding price action, implementing support and resistance levels, combining analysis with technical indicators, and setting entry, stop-loss, and take-profit levels. By mastering these aspects, traders can enhance their ability to identify high-probability trading opportunities and manage risk effectively.

Step-by-Step Analysis of Real-Life Supply and Demand Trading Scenarios

To further understand how to trade forex using supply and demand, it can be helpful to explore step-by-step analyses of real-life trading scenarios. These case studies provide practical examples of how traders apply the principles of supply and demand to make trading decisions.

By dissecting these scenarios, traders can gain insights into the process of identifying key levels, analyzing price action, setting entry and exit points, and managing risk.

Walkthrough of Successful Trades Using Supply and Demand Principles

Examining successful trades that have utilized supply and demand principles can be enlightening for traders seeking practical examples. By walking through these trades, traders can see how the identification of key supply and demand levels, along with the analysis of price action and market structure, influenced the decision-making process.

These walkthroughs can also shed light on how technical indicators were used in conjunction with supply and demand analysis to confirm trade entries and exits.

While supply and demand trading has its core principles, there are various approaches and variations within this strategy.

Traders may incorporate different techniques, such as using multiple timeframes, trend analysis, or volume analysis, to enhance their supply and demand trading.

Comparing these different approaches can provide a broader understanding of the possibilities and help to identify which variations may align best with the trading style and objectives.

Lessons Learned from Unsuccessful Trades and How to Avoid Common Pitfalls

Unsuccessful trades can offer valuable lessons and insights. By analyzing trades that did not go as planned, speculators can identify common pitfalls and mistakes to avoid in their trading.

Perhaps a misinterpretation of price action or a failure to properly manage risk led to the trade’s failure. These case studies can serve as reminders to be diligent in the analysis process, stick to trading plans, and adapt when necessary.

By examining both successful and unsuccessful trades, FX speculators can gain a comprehensive understanding of the strengths and weaknesses of supply and demand trading. It allows them to refine their skills, identify potential areas for improvement, and develop a more robust trading approach.

In conclusion, case studies and practical examples provide traders with real-world applications of supply and demand trading principles. They offer insights into step-by-step analyses, successful trade walkthroughs, variations within the strategy, and lessons learned from unsuccessful trades.

By studying these examples, retail participants can enhance their understanding, sharpen their skills, and increase their chances of success when trading forex using supply and demand.

Utilizing Timeframe Synchronization for Higher Accuracy

One advanced technique in supply and demand trading involves utilizing timeframe synchronization. This technique involves analyzing supply and demand levels across multiple timeframes to increase the accuracy of trading decisions.

By aligning supply and demand zones on different timeframes, traders can identify areas of confluence and strengthen their trading signals. For example, if a supply zone on the hourly chart aligns with a supply zone on the daily chart, it can provide a more robust trading opportunity.

Incorporating Volume Analysis into Supply and Demand Strategies

Volume analysis can be a valuable tool when applied to supply and demand trading strategies. By analyzing tick-volume, or volume derived from the Futures market, alongside supply and demand zones, traders can gain insights into the strength and conviction behind price movements.

Higher volume at key supply or demand levels can confirm the significance of those zones, and subsequent strong directional move away from the zone, while low volume can indicate potential weakness or lack of interest. The same is true if the volume divergence is observed at the supply or demand areas which may indicate potential weakness in the following price action.

Integrating volume and VSA (Volume Spread Analysis) techniques into supply and demand strategies can enhance decision-making and improve trading outcomes.

Understanding the Impact of News Events on Supply and Demand Levels

News events can significantly impact supply and demand levels in the forex market. Economic announcements, geopolitical developments, or central bank decisions can create sudden shifts in market sentiment and temporarily alter the balance between supply and demand.

We as traders should stay informed about upcoming news events and consider their potential impact on key support and resistance levels. Adjusting trading strategies, managing risk, or temporarily avoiding trading around major news events can help navigate these volatile periods more effectively.

Fine-Tuning Entry and Exit Strategies Based on Market Conditions

Supply and demand trading requires adaptability and the ability to fine-tune entry and exit strategies based on market conditions. Different market environments may require adjustments to trading approaches.

For example, in a trending market, traders may focus on pullbacks to areas of demand in an uptrend, or focus on pullbacks into a supply in down-trending conditions for entry opportunities for continuation moves.

In a ranging market, traders may look for reversals at the boundaries of the range. By recognizing and adapting to market conditions, traders can increase the effectiveness of their trading strategies.

Continuous Learning and Adapting to Evolving Market Dynamics

To excel in supply and demand trading, it is essential to embrace a mindset of continuous learning and adaptation. The FX market is dynamic and constantly evolving, influenced by various factors, as discussed before; economic developments and geopolitical events.

Speculators should stay updated on market trends, seek out educational resources, and actively participate in trading communities to expand their knowledge and refine their skills.

“By remaining open to new ideas and adapting their strategies as needed, traders can stay ahead of the curve and improve their long-term trading success. Basically, the homework that is done before placing a trade plays a crucial role in the successful outcomes of the very same trades.”

In summary, advanced techniques and tips for supply and demand trading include; utilizing timeframe synchronization, incorporating volume analysis, understanding the impact of news events, fine-tuning entry and exit strategies, and embracing continuous learning and adaptation.

These practices can enhance the accuracy and effectiveness of supply and demand trading strategies, helping traders navigate the complexities of the forex market and achieve consistent profitability.

To Conclude:

In the article, we explored the concept of trading forex using supply and demand concepts. We discussed the profitability and the potential risks and challenges associated with supply and demand trading.

We delved into the practical aspects of trading, including identifying key supply and demand levels, understanding price action and market structure, implementing support and resistance zones, combining analysis with technical indicators, and setting entry, stop-loss, and take-profit levels.

Finally, we explored advanced techniques such as multiple timeframe synchronization and volume analysis.

Throughout the discussion, it became evident that supply and demand trading can be an effective and profitable approach in the forex market. By focusing on the interaction between supply and demand zones, traders can gain insights into market dynamics and identify high-probability trading opportunities.

This method allows traders to align their trades with the underlying forces driving price movements, potentially increasing the accuracy of their trading decisions.

However, it is important to note that profitability depends on a trader’s skills, experience, and ability to adapt to changing market conditions.

Integrating supply and demand analysis into one’s trading toolbox can be highly beneficial. By mastering the concepts and techniques discussed in this article, traders can develop a solid foundation for making informed trading decisions based on supply and demand concepts.

The key is to combine theory with practice, and continuously learn from real-life examples and experiences. By embracing the principles of supply and demand trading, traders can enhance their overall trading approach and work towards achieving long-term profitability in the forex market.

Start exploring and applying these principles today to take your forex trading to new heights.