Forex, like any other form of market speculation, requires a unique blend of analytical and creative trading thinking. Successful traders understand that simply crunching numbers and analyzing charts isn’t enough to make profitable trades. They must also be able to think creatively and adapt to changing market conditions.

However, forex trading is also a high-risk and high-reward activity that demands a rational and disciplined approach to the market. To succeed, traders must strike a balance between their analytical and creative Forex trading thinking, constantly analyzing data while also remaining flexible and open to new possibilities.

This is where the concept of left-brain and right-brain forex trading thinking comes into play.

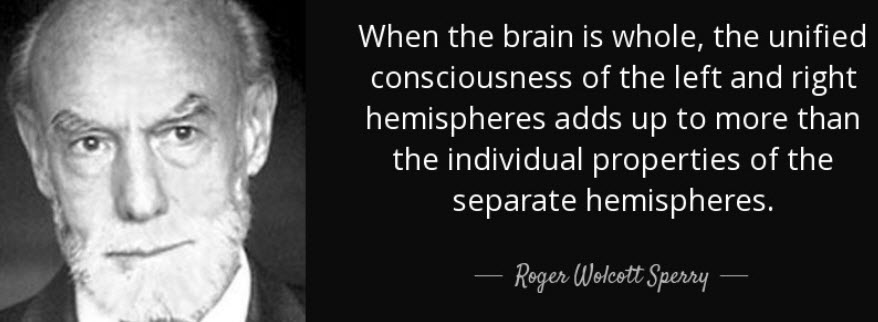

The concept of left-brain and right-brain thinking was first introduced by Roger W. Sperry, who won a Nobel Prize for his research in the 1970s. He suggested that the two hemispheres of the brain are responsible for different types of thinking.

In his words, each hemisphere is:

“… both the left and the right hemisphere may be conscious simultaneously in different, even in mutually conflicting, mental experiences that run along in parallel.”

— Roger Wolcott Sperry, 1974

The left brain is associated with analytical thinking, logic, and rationality, while the right brain is associated with creative thinking, intuition, and emotion.

The idea of left-brain and right-brain dominance has been popular in the past, however, recent studies have shown that the brain is much more complex than this simplified view and that both hemispheres work together in most cognitive tasks, including trading.

By cultivating a balanced approach to Forex trading thinking, traders can leverage both sides of the brain to make informed and intuitive trading decisions.

Learn how to harness the power of both hemispheres of your brain to become a more successful Forex trader.

Left-Brain Forex Trading

One approach that has gained popularity in recent years is left-brain trading. Left-brain traders are analytical, logical, and data-driven.

They rely heavily on technical analysis to make trading decisions. Technical analysis involves studying price charts and identifying patterns that can be used to predict future price movements.

One of the biggest advantages of left-brain trading is its simplicity. Traders can use well-established trading strategies and techniques to make informed decisions, based on pure price-action, and using just charts.

There is a wealth of information available on technical analysis and trading indicators, making it relatively easy to learn and apply. This approach provides a clear and structured framework that helps traders to avoid emotional decisions, which can be a major pitfall for traders who rely on their intuition or gut feeling.

Left-brain traders also tend to be good at risk management. They set clear trading goals, establish stop-loss levels to limit their losses and use position sizing to manage their risk. This approach helps them to minimize their losses and maximize their profits.

However, one of the limitations of left-brain trading is that it can sometimes overlook market trends and changes that cannot be easily quantified. Simply because the Forex market is dynamic and always forward-looking.

There are many factors that can influence price movements, such as political events, economic data releases, and changes in sentiment. Left-brain traders may miss out on these opportunities if they rely solely on technical analysis and ignore other factors.

Despite these limitations, many successful traders have used left-brain trading to achieve success in the Forex market. One of the most well-known left-brain speculators is, no other than, Warren Buffett, who is famous for his value investing approach. Buffett uses fundamental analysis to identify undervalued companies and invests in them for the long term. He has been highly successful, with a net worth of over $100 billion.

Another famous left-brain trader is George Soros, who is known for his macroeconomic approach to trading. Soros uses a top-down approach to identify trends in the global economy and invests in currencies that he believes will benefit from these trends. He famously made a billion dollars by shorting the British pound in 1992.

In summary, left-brain trading is a market approach that emphasizes data, analysis, and logic. It is relatively easy to learn and apply, and it provides a clear and structured approach to trading.

However, it can sometimes overlook market trends and changes that cannot be easily quantified. Successful left-brain traders, such as Warren Buffett and George Soros, have achieved great success in the markets by using this approach.

Right-Brain Forex Trading

While left-brain thinking is often associated with success in trading, there is also a place for right-brain thinking in the Forex market.

Right-brain traders rely on trading intuition, creativity, and emotion to make speculative decisions. They have a more flexible and adaptable approach to trading, and they are excellent at identifying market trends and changes that cannot be easily quantified.

Rather than relying solely on technical analysis, right-brain traders use their trading instincts and creativity to find opportunities that may not be evident from a purely analytical perspective.

Right-brain traders can use their intuition and creativity to identify emerging trends, spot market inefficiencies, and take advantage of market volatility. This approach can be particularly useful in volatile markets, where market conditions can change rapidly, and traders need to be able to adapt quickly.

However, right-brain trading can also be risky as it can lead to impulsive and emotional decisions.

Right-brain traders may be more prone to taking on excessive risk, chasing after losses, or making decisions based on emotions rather than logic. They may also struggle with risk management, as their intuitive approach may not always align with risk management principles.

Despite these risks, many successful traders have used right-brain thinking to achieve success in the markets.

One of the most well-known right-brain traders is Jesse Livermore, who relied on his gut instincts and intuition to make trades. Livermore was a pioneer in the field of technical analysis, but he also used his intuition to make decisions.

He famously made millions of dollars in the stock market in the early 1900s, but he also suffered significant losses due to his impulsive and emotional decisions.

Another successful right-brain trader is Paul Tudor Jones, who combines technical analysis with intuition and creativity to develop his trading strategies. Jones is known for his ability to identify market trends before they become evident to others.

He uses his intuition to identify emerging trends and his creativity to develop trading strategies that take advantage of these trends. He is also known for his risk management skills, which allow him to manage risk effectively while still taking advantage of market opportunities.

To summarize, right-brain Forex trading is an approach that emphasizes intuition, creativity, and emotion. It can uncover opportunities that may not be evident from a purely analytical perspective, but it can also be risky due to the potential for impulsive and emotional decisions.

Successful right-brain traders have achieved great success in the markets by combining their intuitive approach with risk management principles and a strong understanding of market dynamics.

Traders might have various questions when addressing the topic of forex trading thinking to determine if they are left-brain or right-brain traders.

Some potential questions could include:

Are there any online tests to find out if I am a Left-brain or a Right-brain forex trader?

Unfortunately, there are no definitive online tests that can determine whether you are a left-brain or a right-brain forex trader. However, you can take some general tests to assess your cognitive preferences and learning styles.

Here are a few examples:

- Myers-Briggs: Type Indicator (MBTI): This is a personality test that assesses your psychological preferences in how you perceive the world and make decisions. Knowing your personality type can help you understand how you approach trading, what motivates you, and how you interact with others in the trading environment.

- DiSC Assessment: This is a behavioral assessment tool that measures your dominant behavioral traits in four areas: dominance, influence, steadiness, and conscientiousness. Understanding your behavioral style can help you identify your strengths and weaknesses as a trader and work on improving your performance.

- Trading Style Assessment: This type of assessment is specifically designed for traders and measures your trading style preferences, such as risk tolerance, trading frequency, time horizon, and market focus. Knowing your trading style can help you tailor your trading strategy and make better-informed decisions.

- Emotional Intelligence: (EI) Test: EI refers to your ability to recognize and manage your emotions and the emotions of others. High EI is linked to better decision-making and performance in trading. An EI test can help you identify areas where you can improve your emotional awareness and regulation.

It’s important to note that while these tests can give you some insight into your cognitive preferences, they are not definitive or absolute. Forex trading requires a combination of both analytical and creative thinking, and successful traders often use both sides of their brains in their decision-making process.

How do left-brain and right-brain traders approach risk management, decision-making, and other important aspects of trading differently?

Left-brain and right-brain traders may approach risk management, decision-making, and other important aspects of trading differently based on their cognitive preferences:

Risk management

Left-brain traders may be more focused on quantitative analysis and may rely on technical indicators and mathematical models to assess risk and determine entry and exit points. Right-brain traders may be more intuitive and may rely on gut instincts and market sentiment to manage risk.

Decision-making

Left-brain traders may be more analytical and methodical in their decision-making process, while right-brain traders may be more creative in their market approach and intuitive. Left-brain traders may rely on data analysis and logical reasoning to make decisions, while right-brain traders may be more inclined to use their speculative instincts and discretionary trading abilities.

Market analysis

Left-brain traders may be more inclined to use technical analysis, and quantitative models to evaluate market trends and patterns, while right-brain traders may be more interested in using fundamental analysis, geopolitics, global macro, and other qualitative factors to assess market conditions.

Trading psychology

Left-brain traders may be more disciplined and systematic in their approach to trading psychology, using techniques such as goal-setting and discipline to stay focused and motivated. Right-brain traders may be more attuned to their emotions and may use techniques such as mindfulness, visualization, and meditation to stay centered and manage stress.

It’s important to note that these are generalizations, and individual traders may exhibit a combination of both, left-brain and right-brain tendencies. Successful traders are those who are able to integrate both analytical and intuitive thinking in their decision-making process and adapt to changing market conditions.

Regardless of cognitive style, effective risk management, decision-making, market analysis, and trading psychology are all essential components of successful trading.

Can understanding whether I am a left-brain or right-brain trader help me improve my overall trading performance, and if so, how?

While the notion of left-brain or right-brain dominance has been largely debunked, there is some evidence to suggest that different cognitive styles may affect how traders approach trading and make decisions.

However, it’s important to note that there is no one-size-fits-all approach to trading, and as mentioned before, the most successful traders are those who are able to integrate both analytical and intuitive forex trading thinking in their decision-making process.

That being said, understanding your cognitive style can help you identify your strengths and weaknesses as a trader and develop a trading style that aligns with your natural tendencies.

For example, if you tend to be more analytical and quantitative in your forex trading thinking, you may excel at developing and testing trading models and algorithms.

On the other hand, if you tend to be more intuitive and creative, you may be better at identifying market shifts and developing discretionary trading strategies.

To improve your overall trading performance, it’s important to focus on developing a well-rounded set of skills that includes both analytical and intuitive thinking, as well as risk management, trading psychology, and market analysis. Some strategies that may be particularly helpful for left-brain or right-brain traders include:

- Left-brain traders: Focus on developing your analytical and quantitative skills through technical analysis, creating trading models and algorithms, and monitoring market data. Consider using tools such as spreadsheets and data-driven software to help you analyze and interpret statistical information.

- Right-brain traders: Focus on developing your intuition and creativity through activities such as brainstorming new speculative ideas, exploring alternative trading strategies, and experimenting with new approaches to trading, such as; “correlation,” or “volatility expansion” trades. Consider using tools such as forex heat-maps or forex sentiment to help you generate new ideas.

Ultimately, the key to improving your trading performance is to be adaptable and willing to learn. By understanding your cognitive style and developing a well-rounded set of skills, you can become a more effective and successful trader.

Combining Left-Brain and Right-Brain Approaches

While both left-brain and right-brain thinking have their advantages and disadvantages, the best approach to Forex trading is to combine the two.

As discussed before, left-brain thinking provides structure and analytical thinking, while right-brain thinking offers flexibility, creativity, and intuition.

Therefore, the best approach to trading, in our opinion, is to combine left-brain and right-brain forex trading thinking. By using both analytical and intuitive thinking, traders can make more informed and profitable trading decisions.

To balance left-brain and right-brain thinking in the markets, traders should:

- Develop a clear and structured trading plan based on analysis and logic.

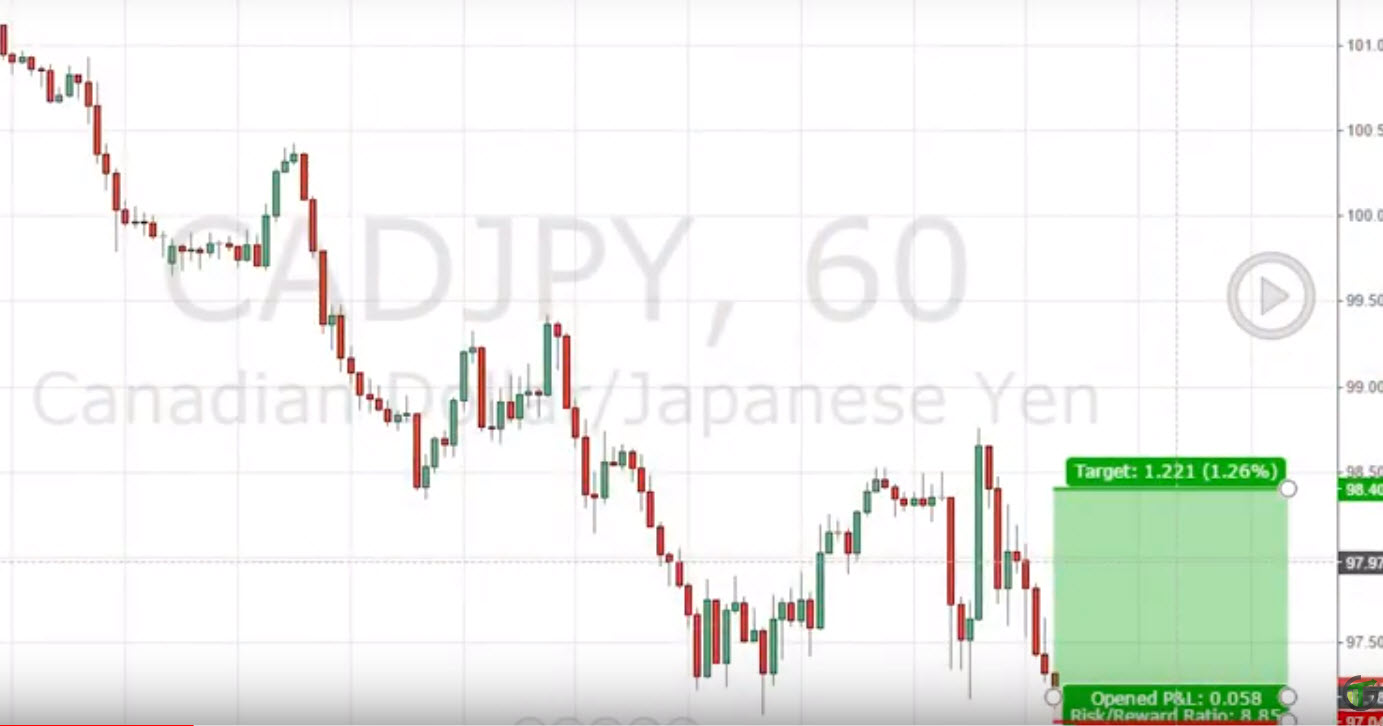

- Use technical indicators and charts to identify potential trading opportunities.

- Pay attention to their intuition and emotions to make decisions based on market trends and changes.

- Practice good risk management and be disciplined in executing the trading plan.

Here are some tips for combining left-brain and right-brain approaches to Forex trading:

Use Technical Analysis

Technical analysis is an important part of left-brain thinking. It involves the use of technical charts with indicators to analyze and identify potential trading opportunities. Traders who use technical analysis often use chart patterns, moving averages, and other technical indicators such as; market profile, order flow, and deltas, to help identify market conditions and their changes.

Incorporate Fundamental Analysis

Fundamental analysis is another important part of right-brain thinking. It involves the analysis of economic and financial data to identify potential trading opportunities. Traders who use fundamental analysis often look at economic indicators, such as CPI, Inflation, and Interest rates, to help identify potential market trends based on the Central Banks’ actions to various economic conditions.

Follow Market Trends

Market trends are an important part of both left-brain and right-brain thinking. Traders who follow market trends use both technical and fundamental analysis to identify potential market shifts. To be precise, fundamental analysis is being used for identifying emerging trends and taking advantage of market inefficiencies, while technical analysis, is for timing entries and exits.

Practice Patience

Patience is an important part of both left-brain and right-brain thinking. Traders who practice patience are more likely to make well-defined trading decisions. They take the time to analyze market trends from different perspectives before making solid decisions.

Manage Risk

Risk management is an important part of both left-brain and right-brain thinking. Traders who manage risk effectively are more likely to be successful in Forex trading. They use stop-loss orders, hedging techniques, and various risk management tools to help manage their overall market exposure.

Learn From Mistakes

Learning from mistakes is an important part of both left-brain and right-brain thinking. Traders who learn from their mistakes are more psychologically mature in their Forex trading. First, they document then, they analyze trading decisions and make adjustments to their trading strategies in a constructive manner.

Conclusion

In conclusion, Forex trading requires a balanced approach that incorporates both left-brain and right-brain thinking. Traders who rely solely on one approach risk missing out on potential opportunities or making emotional decisions that can lead to losses.

Left-brain Forex trading, with its reliance on data, analysis, and logic, is a structured and straightforward approach to trading. It is excellent for identifying patterns, interpreting technical indicators, and setting clear trading goals. However, it can be limiting as it may overlook certain market tendencies and changes that cannot be easily quantified.

On the other hand, right-brain Forex trading relies on speculative intuition, creativity, and emotional maturity. They can uncover opportunities that may not be evident from a purely analytical perspective, but it can also be risky as it can lead to overly impulsive and emotional decisions.

Combining both approaches allows traders to take advantage of the strengths of each and minimize their weaknesses. By using a balanced approach, traders can identify potential opportunities through technical analysis and also rely on their intuition to make informed and profitable trading decisions.