Learn how to use ATR stop loss in your trading from a fellow trader. Below, is his personal experience on this underrated Topic.

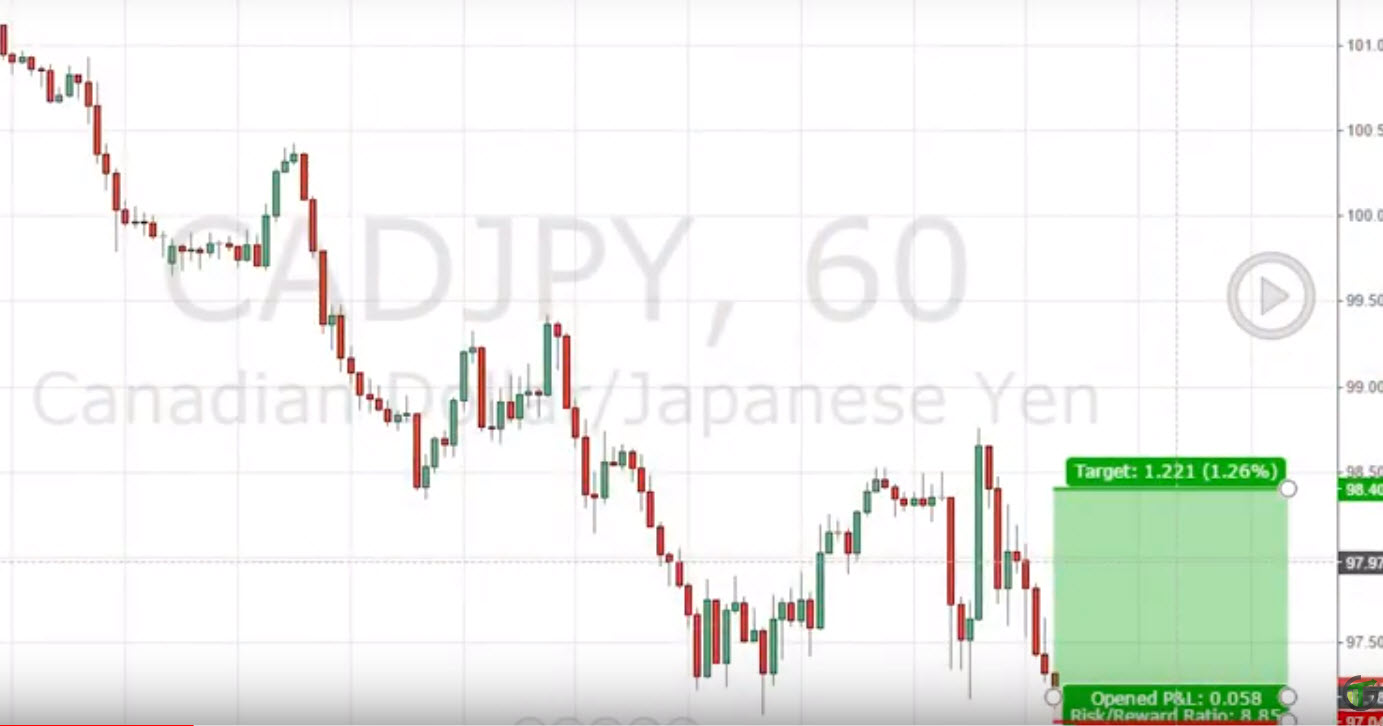

“One of the swing trades in Forex I did last month was buying the Canadian dollar against the Japanese Yen. It was a promising trade, having a high reward, low risk ratio (RR) of almost 9:1! Shortly after opening the position though, my stop loss was hit. Should I have used the ATR % stop method, the trade would have been successful.

I can’t think of anything worse in trading. That’s when market hits your stop loss and carries on to confirm your prediction! The problem was that I wasn’t aware of this stop loss strategy. And here’s how being social in the trading world helps your performance.

Not to mention enriching your knowledge! I had published my opinion on CADJPY at TradingView, as I usually do for most of my high RR trades.

TradingView notified me that my idea had received a comment 10 days later! My trading idea would have been forgotten if it weren’t for a trader commenting on the original chart! His comment was “You should have used an ATR stop, it would have been a perfect trade” A perfect trade? How come? It had resulted in a loss…

Was I wrong? I went back to my original chart. It turned out that, if my stop loss had been set a bit further below my entry price, the trade would indeed be a profitable one! Let me remind you that it had a Risk/Reward ratio of 9:1! It would have won me the TradingView’s Bullseye of the Week Award! But what is an ATR stop?

Upon searching for the term at Google, Investopedia’s article came up. So, let’s see how I should have used the ATR stop method on this particular trade. The ATR indicator helps to identify volatility over a specified period of time. A higher ATR indicates a more volatile market, while a lower ATR indicates a less volatile market.

On the date of my entry (15 January) ATR was around 1.30. I went long at and set the stop loss at 97.04. Given I was swing trading CADJPY, I should have set my stop loss at 50% of the ATR according to Investopedia. Hence, I should have set the stop loss at 65 pips below the entry price, instead of 14.

Also, check: The Truth, Why you’ll NEVER make money trading Forex…

That would be at 96.53. Here’s how my original trade would look like with an ATR % stop loss:

Ta-da! CADJPY price would have hit the profit target a week later. Sure that wouldn’t entitle me to win the Bullseye award. Yet, my trading account would welcome the profit! Of course, setting a less tight stop loss would also hurt the RR of the trade. But that would be counter measured by the increased winning trades. I’m always after the latter, which will result in less variance to my trading capital.

So, here you go. If you find your stop loss getting hit more than expected, give the ATR stop method a go. And don’t be shy of your trading picks. Even bad trades can result in a positive way, such as you becoming a better trader via socializing…” – Jim Makos

I hope You’ve found the post informative, and learned how to use ATR stop loss in trading.

As found on Youtube